Africa Tech Trends: Nigerian hotel booking platform attracts $1.2m in funding

Africa Tech Trends is a fortnightly column by Tom Jackson focusing on the most important developments in Africa’s technology industry, and examining how technology is disrupting the way business is being done on the continent.

African start-ups attracting increasing interest

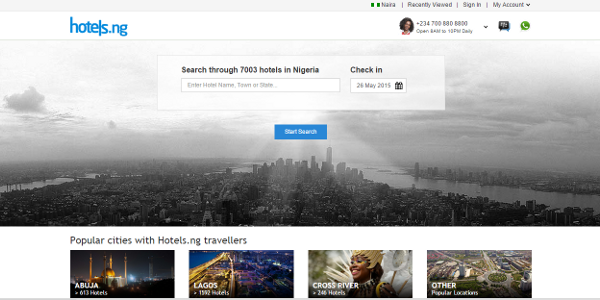

Overnight, the news broke that Nigerian online hotel booking platform Hotels.ng had raised a US$1.2m Series A funding round from Omidyar Network and EchoVC, which will allow the start-up to complete its Nigerian coverage and expand across Africa.

Even bigger news was announced the week before last, with Kenya’s Weza Tele acquired by financial services group AFB for $1.7m. Weza Tele is a leading provider of innovative value-added mobility solutions in commerce, supply chain, distribution and mobile payment integration.

The lack of exits has long been given as a reason why investors are put off from funding African startups. Weza Tele’s is the biggest yet in Kenya, and the hope is it will serve to spur both international and local investors to put money in local start-ups.

This is a continuation of a trend I first noted in this column back in February, and one which should only continue to develop over the course of this year and beyond. Mobile operators are launching VC funds, and new investment funds are arriving on African shores. VC4Africa’s Venture Finance in Africa report was good news enough, with total capital investment in African start-ups reported to have doubled in 2014. But there is enough evidence already in 2015 to suggest we are in for a bumper year.

Nigerian fuel crisis shows mobile operators should dump infrastructure

Nigeria’s fuel crisis, now reportedly resolved, held a significant threat to the country’s mobile operators, with market leader MTN warning it could be forced to shut down its network due to the shortage of diesel.

Let’s look past the unbelievable fact that Nigeria, in spite of being Africa’s biggest oil producer, lacks local refineries and is forced to import petrol and diesel. From the point of view of the mobile operators, it should serve as yet further proof that they need to dispose of the hassles or maintaining their own infrastructure.

This column has discussed before the growing trend of African mobile operators selling off their tower infrastructure to private management firms. MTN itself has shed some of its towers in Nigeria, but not all of them. The benefit to operators is a reduction in costs, which allows them to focus solely on customer service. Incidences like this should only serve to further convince mobile firms that maintaining their own infrastructure is a disaster waiting to happen. Better to let go of the responsibility and focus on customers.

Fintech taking off in Africa

Financial technology – or “fintech” – is becoming bigger business by the day globally. Consultancy Accenture says investment in fintech across the world grew 201% in 2014 to pass $12bn. And if fintech is attractive elsewhere, there is no reason why it should not also flourish in Africa.

According to McKinsey, as much as 80% of Africa’s population is unbanked, or not connected to formal financial services. Credit and debit card use is less than 2% of all retail transactions. Remittances are big business, but the costs are too high. The whole sector is ripe for disruption. This should encourage startups in the sector that opportunities exist. They need only look at global investor interest, the international banks and companies coming to Africa in the search for fintech solutions, and the size of the problem they are tackling.