Research: Tackling the energy crisis in Nigeria – a case for solar

The author, Ola Olaniyi, is a Director at Triox Capital. This article was written specifically for the NTU-SBF Centre for African Studies, a trilateral platform for government, business and academia to promote knowledge and expertise on Africa, established by Nanyang Technological University and the Singapore Business Federation.

Electricity generation and distribution in Nigeria remains erratic. Only 50% of the population have access to electricity, and more than 90 million Nigerians – about the population of Singapore, Malaysia and Thailand combined – are without access to electricity. Access in rural areas is even worse with only 10% of the population having access.

Ongoing industry reform and privatisation efforts by the government are encouraging, but continue to face significant challenges to drive the investments required to breathe new life into the power industry. While most of the ongoing efforts are focused on utility-scale power generation and transmission, the ability to scale solar power generation to meet specific types of demand – residential, distributed, and utility-scale – makes solar a particularly attractive solution to contribute to solving Nigeria’s power challenges.

In addition, the abundance of a free fuel source, the falling cost of PV solar panels, the ease and speed of installation, low operations and maintenance costs, modularity, and energy security make solar an attractive source of energy for the Nigerian economy.

Finally, the ability to deliver energy from solar PV to targeted clusters of small- and medium-scale enterprises (SMEs), makes the technology a key potential driver of economic growth. These, in turn, represent significant investment opportunities to potential investors.

A nation full of potential, fraught with challenges

Nigeria, the largest country in Africa, by population and GDP, suffers from significant power shortages. With a population of 186 million inhabitants, Nigeria accounts for close to half of West Africa’s total population, while its GDP of US$405bn makes the country Africa’s largest economy. The country possesses some of the world’s richest energy resources – proven crude oil reserves of 37.5 billion barrels, a proven natural gas reserve of 190 trillion cubic feet, and proven recoverable coal reserves of 190 million tonnes.

However, most of Nigeria’s population and businesses remain in perpetual darkness due to significant power shortages. Nigeria has a total installed generating capacity of 10,400 megawatts (MW), although only 4,500MW is available for generation. Actual average generation drops even further. Less than 40% of the country is connected to the national grid and between 20% and 30% of generated electricity is lost due to poor transmission. The result – approximately half of Nigeria’s 186 million population currently does not have access to electricity, while those that are connected, suffer from extensive power outages. According to the National Bureau of Statistics, the national average for electricity supply is 35 hours per week or 5 hours per day.

By comparison, South Africa, the continent’s third-largest economy by GDP with a population of 56 million inhabitants, generates 31,880MW compared to Nigeria’s 4,500MW. Seventy-seven percent of South Africa’s population have access to electricity, compared to Nigeria’s 50%. Nigeria’s per capita power consumption of less than 150kWh is one of the lowest in Africa (Figure 1), lower than those of many less developed countries, including the Republic of Congo, Zimbabwe, Yemen and Togo. According to CSL Research, the total power supply is equivalent to electricity supplied to the cities of Liverpool and Manchester, which have a combined population of 1% of Nigeria’s population.

Figure 1: Power generation per capita (2010). Source: U.S. Energy Information Administration, CSL Research

It is important to note, however, that Nigeria’s power problems are not limited to generation capacity. Poorly maintained infrastructure results in a significant loss of power transmission capabilities. The persistent interruption of gas supply to the existing power generating plants and the vandalisation of the existing infrastructure, are additional factors leading to poor electricity supply.

Multiple paths to energy availability

Given Nigeria’s enormous shortage in power generation, the country needs to pursue all possible generation sources available to it.

Nigeria is blessed with significant natural resources, including abundant deposits of non-renewable fossil fuels. The country has proven crude oil reserves of 37.5 billion barrels, with an average daily production of about 1.5 million barrels. In addition, Nigeria has a proven natural gas reserve of 190 trillion cubic feet. The 11 known coal deposits that account for proven recoverable reserves of 190 million tonnes of coal, are an additional potential source of energy.

Today, 82.4% of Nigeria’s electricity production comes from natural gas, while the balance is sourced from hydropower (Figure 2). There are ongoing efforts to develop coal-fired power plants, including Geometric Power’s 1,000MW plant in Enugu.

Figure 2: Nigeria – sources of electricity production (%). Source: The World Bank – World Development Indicators: Electricity production, sources, and access

On the renewable energy front, the four existing hydropower plants in Kainji, Jebba, Shiroro and Zamfara currently supply 17.4% of the country’s electricity generation and have a combined generation capacity of about 2,000MW. There are also plans for additional hydropower plants at, amongst others, Kano, Kiri and Mambilla. In the meanwhile, the Nigerian Bulk Electricity Trading Company has signed a number of power purchase agreements (PPAs) for solar projects at different stages of development, totaling approximately 975MW. Currently, however, there is no utility-scale, grid-connected solar or wind power plant.

Various energy options need to be pursued to improve the current state of electricity generation and transmission in Nigeria.

The case for solar

As things currently stand, Nigeria does not have the luxury of cherry-picking one source of power over another, and there are a number of factors that make solar energy particularly appealing. While some small-scale, mostly-captive, solar power plants are in operation in Nigeria, it does not currently contribute in any significant way to Nigeria’s power generation. Solar thus presents itself as a viable source to complement existing energy sources for the reasons mentioned below.

1. The abundant availability of sunshine

Nigeria lies between latitudes 4° and 14o north of the Equator. This relative proximity to the equator means the country enjoys significant irradiation, resulting in strong solar energy potential (Figure 3).

Average annual irradiation ranges from about 1,600kWh/m2 in the southern coastal region to over 2,200kWh/m2 in the northern, semi arid regions (Figure 4). Given the high irradiation, especially in the northern parts of the country, solar systems in Nigeria will enjoy relatively high energy output.

2. Falling cost of PV solar panels

The most compelling reason to push for increased solar installations in Nigeria and elsewhere, is the continued decrease in the cost of solar PV panels. Over the past three decades, prices have continued to fall significantly, largely owing to the efficiencies gained in technology improvements and the increase in solar installations around the world.

Figure 5: The Swanson Effect – Historical cost of solar PV models (US$ per watt). Source: Bloomberg, New Energy Finance pv.energytrend.com

Since 1977, prices have fallen from about $77 per watt to current levels of about $0.30 per watt (Figure 5). Swanson’s Effect observes that the price of solar PV modules drops by 20% for every doubling in cumulative volume of PV modules shipped. At the current installation rates, costs are expected to reduce by 50% about every 10 years.

This continued drop in the cost of solar PV modules has made solar energy significantly more competitive with other sources of energy today than ever before. This is especially true for utility-scale solar plants.

According to the US Energy Information Administration (EIA), the levelised cost of electricity (LCOE) for solar power plants entering service in 2022, is $85 per MWh compared to the average LCOE of $102 per MWh for all power plants (Figure 6).

Figure 6: US average LCOE (2016 US$/MWh) for plants entering service in 2022 excluding tax credit. Source: US Energy Information Administration. CS = carbon sequestration; CC = combined cycle; CT = combustion turbine; CCS = carbon capture and storage

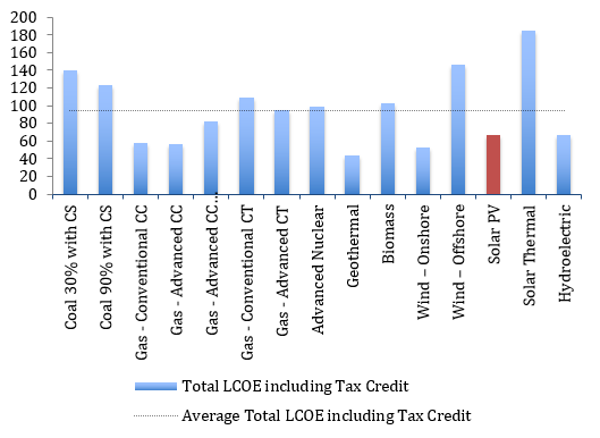

When tax credits are included in the LCOE calculation, solar PV becomes even more competitive. At $66.8 per MWh (Figure 7), solar PV becomes approximately 30% lower than the average LCOE of other energy sources.

Figure 7: US average LCOE (2016 US$/MWh) for plants entering service in 2022 including tax credit. Source: US Energy Information Administration. CS = carbon eequestration; CC = combined cycle; CT = combustion turbine; CCS = carbon capture and storage

Though it is true that fossil fuel energy sources, such as gas-fired and coal-power plants, are still largely cheaper sources of power than solar PV in many parts of the world, the environmental cost of fossil fuel energy is often left unaccounted for. Additionally, the installation costs for solar PV is expected to continue in its decline relative to other sources of energy. According to a January 2017 Bloomberg report (Figure 8), the global average solar cost may fall below coal within 10 years.

Figure 8: Bloomberg – Solar May Beat Coal in a Decade (US$ per MWh). Source: Bloomberg New Energy Finance

3. Ease and speed of installation

Developers of solar PV plants in Nigeria are likely to be constrained by interconnection, payment settlement and other government-related issues. However, once all relevant permits are obtained, designs finalised, and funding secured, large utility-scale, grid-connected solar farms in hundreds of megawatts can be completed within six months. This is especially relevant in the case of Nigeria, where the need to ramp up power generation could not be more dire.

4. Operations and maintenance cost

One of the attractions of solar power plants is the low cost of operations and maintenance (O&M) relative to other energy sources. This is largely driven by the absence of ongoing fuel cost for the life of the plant – sunlight is free.

According to the EIA, for power plants entering service in 2022, total O&M cost for solar PV plants is 23% lower than the average total O&M cost for all energy sources (Figure 9).

Figure 9: O&M costs (2016 US$/MWh) for plants entering service in 2022. Source: US Energy Information Administration

Besides the obvious cost advantage, existing technologies such as remote monitoring, automated panel cleaning systems, etc. reduce the need for significant plant operations overhead, training costs, and human error.

5. Modularity

The modular nature of solar PV makes it especially suitable for Nigeria. The technology lends itself to everything from single-panel residential installations, or commercial-scale or distributed solar farms, to large-scale, grid-connected power plants. Large solar plants can easily be developed in multiple phases, adding more MWs over time.

This implies that in addition to the opportunities for large-scale solar plants to provide additional generation capacity to the national grid, individual homes can complement existing power sources of erratic grid-supplied electricity and diesel generators, with rooftop solar installations. Companies and industries, including those with warehouses, light manufacturing, etc., can complement their existing power sources and reduce their cost of electricity. Also, given that only 50% of Nigeria’s population is currently connected to the grid (Figure 10), solar provides a relatively easy approach to increase electricity delivery, especially to remote parts of the country via off-grid solutions.

6. Energy security

Energy security is defined by availability, affordability and reliability. Reliability of energy supply in Nigeria has been plagued by incessant attacks on infrastructure, leading to major supply disruptions.

In April 2016, Nigeria’s crude oil production dropped by 800,000 barrels per day (Figure 12), when oil pipelines were attacked by a militant group – a practice not uncommon in Nigeria’s recent history. The vandalism of crude oil and gas pipelines often leads to a shut down of gas supply, crippling generation at the country’s gas-fired power plants.

Figure 12: Nigeria crude oil production (‘000 barrels/day). Source: Tradingeconomics.com, Organisation of Petroleum Exporting Countries

Besides vandalism, low gas prices for the power sector, as well as a significant debt overhang to gas suppliers, further disrupts the supply of gas to Nigeria’s gas-fired power generators. According to the Power Sector Recovery Programme, a Nigerian government intervention plan, the total gas supply indebtedness of power producers from January 2015 to December 2016 alone is $500m.

The ability to bypass the vulnerable interstate oil and gas pipelines, which are often subjected to militant attacks, makes solar a particularly attractive energy source for the Nigerian economy. It will provide significant benefits towards energy availability and reliability, contributing meaningfully to energy security.

Investment Opportunities

The opportunities to invest in utility scale solar power plants in Nigeria are significant and the benefits are obvious. While issues surrounding cushions for naira depreciation in the existing PPA framework, interconnection, etc. are getting solved for the handful of projects that have been granted generation licences, it is worthwhile to focus on a few distributed generation (DG) opportunities.

1. DG – potential driver of economic growth

The ability to immediately deliver targeted electricity supply to SMEs could represent a potential transformational opportunity to the Nigerian economy. The growth of SMEs is stunted as they often operate on tight margins where energy cost is a major component of total operating cost. The cost of self-generated power, mostly diesel generators, is estimated to be five to 10 times as much as power from the grid. According to CSL Research, power shortages are estimated to cost the Nigerian economy approximately $250bn in lost GDP annually. By targeting a specific set of industries, such as agriculture and trading, solar energy could deliver the much-needed electricity required to drive productivity, reduce operating cost and increase employment by SMEs.

2. Agriculture / agribusiness

Agriculture is the largest contributor to the Nigerian GDP at 22% and employs 40% of the population (Figure 13). Unfortunately, significant portions – over 80% by some estimates – of Nigeria’s agricultural produce spoils before it gets to market. This is largely due to infrastructure inadequacy, including poor storage and transportation facilities. Solar-powered, centralised farm-gate storage facilities, processing plants, and distribution centers will significantly improve productivity and help smooth out seasonal price fluctuations.

3. Trading

Trading, a space largely dominated by SMEs, is the second largest contributor to GDP at 16.5%. Market clusters such as the Onitsha Market, Oke Arin Market and others could benefit significantly from rooftop DG solar installations to reduce the cost of operations and to improve security and overall productivity.

Conclusion

Nigeria’s severe power supply shortage is primarily driven by extremely low generation capacity, further compounded by poorly maintained infrastructure. This results in a situation where a country of 186 million people survive on less than 4,500 MW of power generation – one of the lowest in the world on a per capita basis.

While every available, economically viable, source of energy should be pursued, solar PV provides an opportunity to immediately deliver solutions at different scales. The ability to provide off-grid or mini-grid power directly to homes and businesses and to deliver large utility-scale power plants, make solar PV especially beneficial to Nigeria. In addition, the ability to avoid expensive interstate pipelines susceptible to vandalism increases the attractiveness of solar PV.

More PPAs will be signed beyond the existing set, and opportunities in utility-scale power plants will remain. However, there is a significant opportunity for developers and investors in providing power solutions directly to clusters of SMEs, especially those involving agribusiness and trading. Developers with distributed power solutions that provide low upfront costs to consumers and ensure an effective billing and collection system, are likely to be winners in this space.

The author, Ola Olaniyi, is a Director at Triox Capital. Prior to Triox, Ola worked as Head of Corporate Development and Acquisitions, Asia Pacific at SunEdison, and in Private Equity at Temasek Holdings. This article was written specifically for the NTU-SBF Centre for African Studies, a trilateral platform for government, business and academia to promote knowledge and expertise on Africa, established by Nanyang Technological University and the Singapore Business Federation. Ola can be reached at [email protected].